It's easy to overlook some of these small yet very important things when you're excited about buying a house—but you'll regret it later.

The 50 Biggest Regrets First-Time Home Buyers Have

Future Development

Forgetting Pre-Approval

Ignoring Old Paint

Skipping the Final Walk-Through

The Commute is Too Long

Roof Leaks

Wiring

Not Saving Enough

Not Doing Enough Research

Wrong Size Home

Waiting for the ‘Perfect’ Home

Millennials buying a home for the first time are up against some hurdles, including the 20% down payment, plus closing costs. With home prices continuing to rise, these hurdles become boulders.

“To play in the market, one must get in the market by buying (and hopefully getting a good deal on) a home that is within their immediate financial striking range,” explains Mia Simon, a Redfin real estate agent in Silicon Valley. “This is difficult for some, as they want the three bedroom/two bathroom home where they can envision raising their children. The problem is that by the time the’ve saved the down payment to afford this house, it has appreciated to the point where it is now unaffordable.” Here are more house hunting and buying mistakes to avoid.

Not Hiring an Agent

“When shopping for homes on online listing services, you’re not really getting the full picture or price,” explains Full Potential Real Estate. “The home might have smells, sounds, or sights that you’re not seeing while looking at the photos on the listing. Not only that, if you’re interested in a home and reach out to the listing agent, they’re not going to have your best interests at heart. They’re legally bound to the seller, so you may not get the best deal.”

Working with a real estate agent in person allows them to know more about your needs and wants, and gives them the opportunity to work for you to find your future home.

Not Shopping For a Mortgage

Finding the home you want is a dream come true. Making an offer and starting the closing process shifts that dream one step closer to reality. Millennials should be mindful that their loyalty by no means belongs to the lender that pre-approved them, however. It’s in your best interest to shop around for the best interest rates and terms that fit your budget.

Not Attending a Home Inspection

This is certainly one of the biggest mistakes millennials can make when purchasing their first home. “Do not let your real estate agent go without you to look over the inspection,” warns Full Potential Real Estate. “Do not send your mother or brother or second cousin on the home inspection. Take off work and walk through the home with the home inspector. In fact, make sure you’re involved with the entire process, including hiring your own personally vetted inspector.”

Once all is said and done, be sure you read the inspection report!

Here are 12 tips for getting the most out of a home inspection.

Not Getting a Home Warranty

Millennials should ask for a home warranty during closing. A home warranty is an annual service contract that covers the repair or replacement of important appliances and systems. While home warranty policies vary, most cover major appliances, as well as heating/cooling, plumbing and electrical systems.

Unless you purchase a brand new house, you can expect things to wear out and break down, which is why getting a home warranty is so important. It could provide major savings when you need it most.

Who pays for the warranty depends. While real estate agents are known to give buyers a home warranty as a gift after closing, sometimes the seller pays for the coverage to keep the buyer from calling them after closing if something breaks. If neither happens, the buyer should still make the purchase themselves. Before you settle in, you can expect to pay for these 13 things.

Not Factoring In Resale Value

Most millennials buying their first home aren’t swimming in cash, which is why it’s a good idea for them to make sure to factor in resale value when purchasing a home.

“Find something that can build equity (maybe new carpeting, hardwood floors or granite countertops) and that will also appreciate over time (the neighborhood is up and coming, new shops and restaurants are popping up around it),” advises Full Potential Real Estate. While no one can predict the future, millennial home buyers need to think ahead to what the home they’re buying could be worth when they go to sell it.

Not Staying Within Their Budget

It’s easy to look at your mortgage and get caught up in the affordable numbers popping off the page, but this monthly price on the listing doesn’t take into consideration insurance, taxes, homeowner association fees, personal mortgage insurance if your down payment is less than 20 percent, etc. Do the math of these crucial fees to see if you can really swing the house you want with the budget you have. Here are 40 first-time homeowner pitfalls to avoid.

Buying at the Wrong Time

As much as you shouldn’t wait for the perfect home, it’s also important you don’t commit too quickly. “We typically encounter clients whose number one goal is understandably getting a good deal on their home purchase,” says Mia Simon from Redfin. “The advice that we give is to buy when fewer people are buying—Thanksgiving through Mid-January, or during the month of July, when a lot of people go on vacation and the buyer pool is smaller.”

Here are 22 secrets your real estate agent isn’t telling you.

Forgetting About Closing Costs

Buying a house is exciting, but it also requires you to pay for inspection fees, title, escrow and appraisals, along with various other aspects of a real estate transaction. There are a lot of moving parts that first-time home buyers may not be aware of, which a survey from ClosingCorp of San Diego proves, revealing that two-thirds of millennials don’t take closing costs into account when purchasing their first home.

Once you purchase, be sure you don’t undertake these 12 regrettable home renovations.

Emptying Your Savings

Your first home may need various renovations and repairs, which can drain your bank account quickly. In fact, you may not even have money to do such things at all if you emptied your savings account just to purchase your home!

“That’s a growing pain for the first-time homeowner, when stuff breaks,” says John Pataky, executive vice president of the consumer division of EverBank. “They find themselves in a hole quickly.”

That’s why you should ensure you have a savings fund that is specifically meant to cover making a down payment, paying for closing costs, moving expenses and repairs. Here are our top 10 tips for saving money at home.

Misjudging Your Down Payment Amount

It’s easy to borrow money from your local bank, but it’s hard to pay it back! While it’s tempting to use a loan for your entire down payment, first-timers should be weary of mortgage fees. Your best bet is to create a budget for all home expenses, as well as monthly bills, groceries, insurance, etc., so you can have a better idea of what you’ll actually be able to afford for a down payment.

You Don’t Know the Area

You shouldn’t just love the home, you should also love the neighborhood. Not knowing the area and feeling unsure about the neighborhood can be red flags for home buyers.

Appreciation Isn’t Guaranteed

Since housing markets go up and down, it doesn’t mean that when you’re ready to sell you’ll make money. Appreciation isn’t guaranteed when it comes to residential real estate, so consider the long-term when buying.

Get a Second Opinion

Sometimes it’s best to get a second (or third) opinion when looking at a home. A friend or family member may be able to point out things you didn’t see, such as a yard drainage issue or that mold in the corner of the basement.

The Goldilocks Dilemma

According to a recent analysis from CNBC, the biggest regret of new homeowners is buying a home that is either too large or too small. Whether you can’t find the room you need for your family, or you realize that you’re paying for square footage you don’t use, having a home that doesn’t meet your needs is a recipe for frustration.

Avoid this issue by buying for what you need, not what you think you should need. Of course, you can always consider an addition, or use these 15 ideas to make a small room look bigger to expand the feel of your home.

No Emergency Budget

Making the shift from renting to owning can be an exciting way to build long term wealth, but it also carries certain financial burdens of its own. In addition to a mortgage, taxes and insurance, homeowners also need to set aside money for repairs and maintenance. Often called “carrying cost,” these ongoing expenses are simply part of home ownership. You can build these funds gradually, but if your home’s purchase price leaves you with nothing in the bank, you’ll be in trouble if an emergency occurs during your first months of ownership.

Avoid this issue by keeping an emergency fund (many experts suggest between $2,000 and $3,000). Another approach is to invest in a home warranty. And of course, DIYers can keep an emergency home toolkit ready to go.

Forgetting to Ask About Utility Expenses

Get estimates for utility expenses from the real estate agents or current or former homeowners. It helps to know how much it’ll cost for water, waste management and other monthly and annual expenses before you move in. If cable, internet and good cellular service are paramount in your family, be sure to ask questions about those options, too. And remember, there are also ways to save on utility bills after you move in. Also, see how to easy it is boost your cell signal in your home or how to make your Wi-Fi signal stronger in five quick steps.

Waiting to Set Up Utilities

If possible, transition utility accounts to your new address, and set up all installation appointments as close to move-in day as you can. Use apps like Nextdoor.com and social media to ask future neighbors for vendors they’d recommend. File for a change of address with USPS, IRS, and banking.

Moving Willy-Nilly

Use colorful garage sale stickers, or multi-colored masking tape to match each moving box with its final destination. Blue= kitchen, Purple=master bedroom, etc.? This not only helps you on move-in day but any movers or friends helping unload. Buy a few big, permanent markers and really label the boxes with their contents. This will help the inevitable opening of a dozen wrong boxes before finding the one that actually contains the coffee mugs. Plus, don’t throw out your back next time you’re moving a couch with these incredible time-saving moving tips.

Not Making a Prioritized List

The minute you walk in to your new home, your mind will be racing with to-dos. Keep this overwhelming task list at bay by keeping a notebook in a central location and write down every action item you or your family thinks of throughout the day. After 24 hours cut the list off, and prioritize each item with a 1, 2, or 3. First priority should be items completed that week – such as safety concerns, cleaning, unpacking essentials, etc. Priority two should be tasks completed within the next two months – related to organization, maintenance and remaining unpacking. Priority three tasks should be non-essentials, but improvements and projects you’d like to complete within the year – renovations, landscaping, and large purchases. Read this first-time homebuyer’s guide to home maintenance to get started.

Leaving the Locks

It’s a small price for piece of mind. Even if the previous homeowner has handed over their set of keys, there’s no telling who else might still have one. A dog walker, a cleaning lady, a babysitter or family member—it’s easy to imagine someone still having access into your new home, so changing the locks soon after move in will give you security and piece of mind. Same goes for garage door codes. Learn how to rekey a door lock here and plus make sure you know the best hiding places in the house for your valuables.

Forgetting Fire Alarms

Test all fire alarms, replace batteries and add additional alarms where needed. Purchase a carbon monoxide detector and fire extinguisher and establish a fire safety plan early with all family members. Do not rely on the previous owners to keep fire safety up to date. Try these other tips from our field editors to brush up on home fire safety.

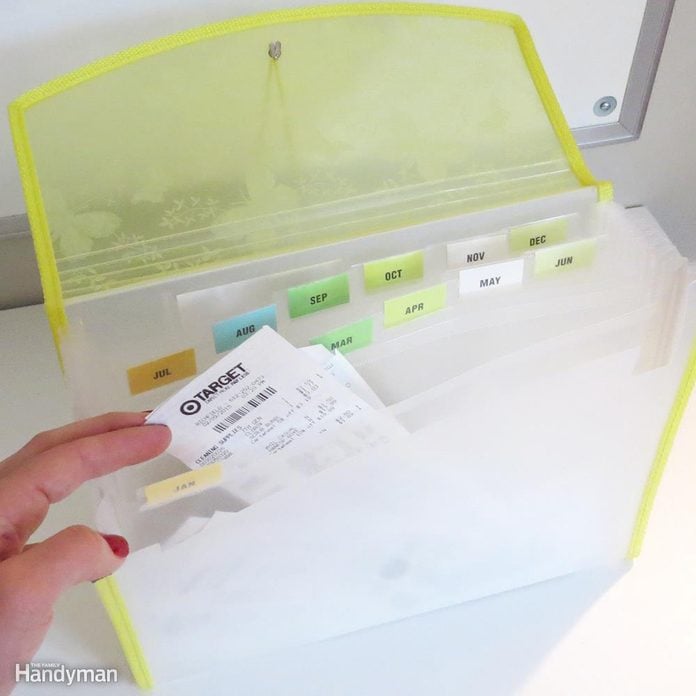

Not Keeping a Homeowner’s Journal

Buy a ring binder and keep insurance papers, repair receipts and all other paperwork pertaining to the house in it. Storing all your house information in one handy place makes life easier for the homeowner and can be a sales ‘plus’ when selling the house later. – reader Debora Emmert

Trusting Too Much

Insist on full written disclosure from the seller about remodeling, repairs, old damage, leaks, mold, etc. Check with the city or county, and get—in writing—the property’s permit history, zoning, prior uses, homeowners’ association restrictions and anything else you can find out. Forget ‘location, location, location.’ I say, ‘Verify, verify, verify!’ —reader readPaul Bianchina. Find out what your taxes pay when you cut a check for your property taxes so you don’t get ripped off.

Overlooking a Home Warranty

We had the seller throw in a home warranty. This saved us from a faulty dishwasher and got us a brand new furnace. — reader Larry Gusman

Picking a Pro From an Internet Search

If you’re looking for plumbers, electricians or other pros, ask your neighbors. You tend to get decent advice if you get it from people who live near you. — reader Bob Bessette.

Forgetting to Clean Refrigerator Coils

Refrigerator condenser coils are located on the back of the fridge or across the bottom. When coils are clogged with dust, pet hair and cobwebs, they can’t efficiently release heat. The result is your compressor works harder and longer than it was designed to, using more energy and shortening the life of your fridge. Clean the coils with a coil-cleaning brush and vacuum. A coil-cleaning brush, which is bendable to fit in tight areas, does a thorough job. Look for one online or at appliance stores. For tips on repairing your refrigerator (without a service call), check out our guide .

Leaving the Lint Screen Dirty

A clogged lint screen or dryer duct drastically reduces the efficiency of your dryer, whether it’s gas or electric. Clean the lint screen after each load and clean the exhaust duct once a year. The Linteater (shown) has an auger brush that attaches to a drill to clean out the ducts.

Electric dryers use about $85 of electricity annually. A dirty lint screen can cause the dryer to use up to 30 percent more electricity, according to the Consumer Energy Center. Lint buildup is also a common cause of fires.

Dry loads of laundry back-to-back so the dryer doesn’t cool down between loads (a warm dryer uses less energy). And only run the dryer until the clothes are dry. Overdrying damages your clothes and runs up your electric bill. If you’re in the market for a new dryer and already have a gas line in the house, go with a gas dryer. A gas dryer is more efficient. Try these tips on how to buy a washer and dryer set.

Forgetting the Furnace Filter

One of the fastest ways to create problems with a forced-air heating and cooling system is to forget to replace the filter. Locate the furnace filter and buy replacements if the previous owners didn’t leave you a stash. Replace the filter (and get in the habit of doing it every month). Here’s how!

Failing to Clean Air Conditioner Condensers and Evaporators

A little sweat equity now will help both your wallet and your comfort level later when summer’s heat sets in. Most of the job can be done without the help of a professional, and by servicing and testing out your cooling system now, you will have plenty of time to make an appointment with an air conditioning contractor if there’s any unforeseen issues. After cutting off the electricity to the unit, vacuum the outdoor condenser’s exterior fins with a soft-bristled brush, and clear away bushes, weeds and overgrown grass within two feet of the unit. Indoors, replace the furnace filter on the evaporator unit, vacuum the blower compartment, and clean the condensation drain. Learn how to clean an air conditioner.

For the full guide to cleaning the air conditioner, click here.

Not Mapping Out Your Home’s Main Water Shutoff Valve

Know where you main water shutoff valve is in case you need to shut off the water to your entire house.

Almost all homes have one main shutoff valve directly before the water meter and another directly after. Where the meter is located depends on the climate in your area. In cold climates, the meter and main shutoff valves are located inside, usually in a basement or other warm area to prevent freezing. In milder climates, the meter and its two shutoff valves may be attached to an exterior wall or nestled in an underground box with a removable lid.

Between the water main in the street and the meter, there’s also usually a buried curb stop valve (accessible only by city workers wielding special long-handled wrenches) and a corporation stop, where your house water line hooks up to the water main. Your city absolutely doesn’t want you messing around with these valves. Turn your water off or on using the main valve on the house side of the meter. This valve will normally be a gate-type valve, with a round knurled handle, requiring several full clockwise rotations to turn off. In newer homes, it could be a ball valve.

Find out more about main water shutoff valves here.

Skipping the Crawlspaces and the Attic

It’s good to familiarize yourself with the farthest corners of your home. Check for leaks, bugs, mold and other issues that you should address sooner rather than later. If your crawlspace doesn’t have a vapor barrier, learn how to install one here.

Ignoring Your Sump Pump Before the Beginning of the Rainy Season

Pour water into it to make sure it works.

The most common time for a sump pump to fail is the first heavy rainfall after months of not being used. The submerged or partially submerged portions of cast iron pumps can rust and seize. And they’ll burn out when they switch on. Don’t get caught with your pump down and the water rising. After a long dry (unused) spell, pour a bucket or two of water into the sump to make sure the pump kicks on.

And do you have sump pump backup? A good sump pump installation should include a backup system for breakdowns and power outages. Learn the pros and cons of four pump backup methods here.

Not Hiding a Key

If you don’t have keyless locks, be sure to hide a house key so you don’t get locked out. Consider a location other than under the welcome mat, like in a garden hose or under a flower pot.

For hiding valuables inside your home, check out these crazy places people have hid things.

Ignoring Garage Door Springs

Coat the overhead torsion springs mounted above roller tracks with a garage door lubricant. All springs will eventually break because of metal fatigue and/or corrosion, but lubing them at least once a year will make them last longer. Spraying can be messy; it’s smart to protect the wall behind the spring with a piece of cardboard. Garage door lubricant is available at home centers. Lube the rollers, hinges and track while you’re at it. Learn more garage door maintenance tips.

Letting Sediment From Your Water Heater Collect

A distraught homeowner called a plumber because her water heater wasn’t heating, and furthermore, it was leaking. Right away, the plumber asked if the homeowner had been draining some of the water from it every year. The puzzled homeowner said, ‘No. Why?’ It turns out that sediment will collect at the bottom of the tank. This creates hot spots on gas-powered heaters that can damage the tank and cause premature failure. On an electric water heater, sediment buildup can cause the lower heating element to fail. So, occasionally draining a water heater will lower energy bills and extend its life. We recommend draining water heaters at least once a year. Plus: 12 DIY Ways to Make Your Stuff Last Way Longer

Not Knowing What You Can Live With and What You Can’t

If this is your first home, consider what you can live with and what you can’t. Perhaps the kitchen isn’t ideal, but you know a few appliance upgrades will do the trick. You wanted two full bathrooms, but can you live with one and a half? Know your must-haves.

Letting Emotions Get Out of Check

Buying a house is stressful, and buying in a competitive market will make it even more so. It’s important to keep your emotions in check, as you may end up overlooking some costly issues and overpaying for a home if your feelings cloud your judgment.

Thinking the School District is Irrelevant to Those Without Kids

It’s a fact: homes in more desirable school districts cost more. This means that even if you don’t have children, when it comes time to sell your home, you’ll be in a stronger position if you’re in a good school district. So don’t buy the myths that schools, parks and rec centers only impact those who use them. There’s a reason that this misperception made this list of 20 things no one tells you about buying a home.

Buyers Remorse is Inevitable

There’s almost no way for a new homeowner to completely avoid buyer’s remorse. The little pitfalls that come with buying a home can be stressful and drive you crazy. The good news is that it’s all worth it! For all of its challenges, home ownership can be mentally and financially rewarding. No matter how stressful it gets, don’t forget that you’re not alone! The Family Handyman community of DIY enthusiasts is here to help you on your journey. If you’re ready to read further, here’s a great place to get started: 13 Great Tips for New Homeowners and First-Time Home Buyers.