Myth: You Need a Ton of Cash to Buy a Home

There once was a time when you needed a 20% down payment to even consider buying a home. And it’s still a great way to avoid private mortgage insurance (PMI). But today, if you want to lock down a good rate, you’re be able to do so with as little as 5% or 10% down. The 20% tradition is a hold-over from decades ago. Let go of that and other myths, and you’ll find a whole new world of options opening up for you.

Myth: All You Need is a Down Payment

But just because you need less up-front than home buyers of yesteryear, it doesn’t mean that you should start home shopping with no savings! You may be able to get the seller to carry closing costs, but there’s no guarantee that will be the case. Further, you’re almost guaranteed to run into expenses with your new home. Repairs, improvements, moving expenses—all of these and more mean that you should have money set aside when you move in. Experts normally suggest around $3,000, but the exact amount will vary with your specific situation. If you have DIY skills, for example, then you can likely get away with less cash on hand than non-DIYers.

Myth: A Scary Basement Should Scare you Off

Like many myths, this one holds a seed of truth. A serious foundation issue can be a large and expensive project to tackle. However, many potential home buyers see a basement as dark, damp and crawling with bugs, whether or not there’s actually a serious problem. But there’s a major difference between serious issues and minor moisture problems. It’s not uncommon for a terrifying basement to look far more welcoming simply by cleaning it out and freshening it up.

If in doubt, get a second opinion—this is one of the reasons a home inspector is so valuable—and then put together a plan. Once you have a tentative timeline and budget, then you can make an informed decision about whether that home, and basement, is right for you.

Myth: School District is Irrelevant to Those Without Kids

It’s a fact: homes in more desirable school districts cost more. This means that even if you don’t have children, when it comes time to sell your home, you’ll be in a stronger position if you’re in a good school district. So don’t buy the myths that schools, parks and rec centers only impact those who use them. There’s a reason that this misperception made this list of 20 things no one tells you about buying a home.

Myth: Owning a Home is Like Minting Money

One of the more persistent myths when it comes to home ownership is the idea that buying a home is a guaranteed positive investment. While it’s certainly true that home values tend to increase, that is not always the case. Further, some studies show that depending on where you live, you may be better off renting, and putting the money you save into an investment account.

The caveat is that it requires you to have the discipline (and luck) to be able to consistently set aside that gap between rent and mortgage costs. Paying against the mortgage is like having a forced savings account, and that wealth slowly but steadily builds up over time. It’s a great way to set aside savings, but that should never be the primary reason to buy a home. And of course, if you can find a few extra dollars, you can still invest. Here’s a few tips on how to boost your savings by using an energy audit to slash your utility bill.

Myth: It’s Your House, You Can Do What You Want!

Most of us like to think that when we own a home we can do whatever we want with it. The reality is that we have to take into account municipal regulations as well as any homeowners association requirements. Zoning and permits vary greatly from area to area, and every homeowners association is an entity unto itself. But no matter where you live, it’s a fact that some home improvements will improve the market value of your home, while others will have no effect, or might even make it harder when it’s time to sell.

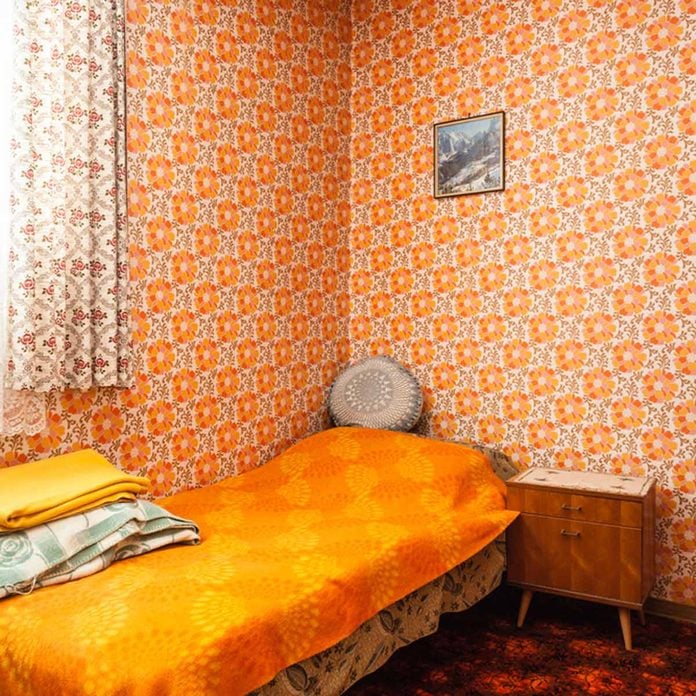

So feel free to go with orange and brown vintage wallpaper if that’s the look you enjoy; just understand that potential buyers might not feel the same way about it as you do! Do a little research into what projects will earn you the biggest return on investment, starting with this great overview.

Myth: Drop Your Insurance After Your Mortgage is Paid

Most mortgages require specific amounts of insurance to be carried by homeowners. It’s certainly aggravating to be required to spend money, but mortgage companies don’t do it just to be irritating. They require insurance because a home is a terribly expensive thing to replace. Far too many homeowners finally managed to pay off their mortgage and owned their home free and clear bilaterally to suffer a tragedy due to fire or natural disaster. Their loss is compounded when it’s discovered that they dropped their homeowners’ insurance once they were no longer required to have it.

Insurance payments may feel like money going out the door, but that’s only when you don’t need it. And when you do? Well, then it’s too late.

Myth: You Need Perfect Credit to Buy a Home

The reality is that while a higher credit score generally allows for a more favorable interest rate, it doesn’t mean that poor credit is an insurmountable hurdle. There are many options available for buyers of all incomes and credit tiers. Talk to your lender and if you hear “no,” keep looking! It may take some research and some time to build up the credit or cash reserves you need, but sooner or later you’ll find the perfect match for your unique situation.

Myth: Your Mortgage Payment is Your Only Expense

Far too many homeowners neglect to consider the holding costs involved in owning and maintaining a home. Most people think they’re accustomed to accounting for utilities in their budget, but they may forget about trash collection and water, which landlords often cover. There are also ongoing repairs and expenses that come with being a homeowner, and those may take new buyers by surprise.

Like many of the myths on this list, the best approach is to be as informed as possible. Actively question your home inspector or other construction and maintenance pros about what kind of repairs and maintenance you should expect, and budget accordingly. And if you’re looking for ways to keep your maintenance costs low, read through this fantastic list of simple and affordable maintenance tips.

Myth: You can Afford any Home if the Payments are Less than 36% of your Income

The old guideline about matching the principal, interest, taxes and insurance (PITI) to 36% of your income is a benchmark that lenders use when first analyzing a potential mortgage. Like most myths, there is a nugget of truth in this one. The 36% guideline is still used by lenders, because they don’t have to consider the whole picture. But of course, the big picture is exactly what you have to be concerned with!

Instead, sit down and track your spending for at least two months to get a feel for what your real budget is. You don’t have to delay the house hunting process, just keep your eye on your spending, watching for any red flags. If owning a home is a big enough goal, it may even inspire you to trim spending in other areas.

Myth: Vacation Homes are a Waste of Money

This is one of those myths that’s held by experienced homeowners as well as newcomers. Owning a vacation home takes a different mindset than owning a personal residence. But that doesn’t mean that they have to be a losing proposition! Vacation homes are often located in high-demand areas and are rented out on a nightly basis at tourist rates, meaning that even moderate occupancy can allow you to break even on the mortgage payments.

The trick to owning a vacation rental is approaching it as a business. When building a budget, factor in expenses for marketing, housekeeping, management, furnishings and guest supplies such as paper towels or bottled water. But there’s one other major factor to keep in mind: chances are you and your family will use that vacation home as well! For many people, a vacation home that breaks even or loses some money is still worth it in the long run, if it allows them to have their own property in a dream destination.

Myth: Don’t Sweat the Home Inspection

You absolutely should have any potential purchase inspected, even if you have DIY experience. After all, a home is a major purchase, and that second pair of eyes is always valuable. If at all possible, inspect the home on your own, then be present for the home inspection proper. You’ll be able to ask questions and point out potential issues.

Myth: The Listing Price is Set in Stone

The real estate market swings back and forth, and each home seller has their own set of circumstances. The listing price of the home it is not like the price of a candy bar at the grocery store. The price on the tag is not written in stone. But it’s important to understand that the listing price is also not like the prices at a used car lot. Unlike the car price, where prices are only ever negotiated in one direction (down) the listing price of a home may be too low, and the contract price will need to go up in order to close a deal.

While most of the myths on this list affect home buyers, this is one that home sellers struggle with as well. Understanding the marketplace and the realities of your personal situation is a tricky proposition and often requires the guidance of a real estate agent or extensive research into your neighborhood. To get started, here’s a list of 40 important things home sellers need to know.

Myth: You Can Time the Real Estate Market

Those who’ve been in the property business for any substantial amount of time can recall neighborhoods that were supposed to “pop” for years or even decades, but for some reason never got started. All the buyers who’d moved in expecting a windfall were disappointed, even if their individual home was perfectly fine. Concentrate on finding the right home for you and your family, instead of trying to win the housing lottery, and you’ll be much happier in the long run. Busting this myth is one of the most essential things a first-time home buyer can learn, along with the rest of this list of home buying secrets.

Myth: The Lowest Interest Rate is Always the Best Mortgage

A mortgage loan is incredibly complicated and any real estate professional can regale you with endless tales of loans and closings going off the rails for one reason or another. With so many different ways for things to go wrong, you want to pick a mortgage lender who understands the business and will work with you and your real estate agent to achieve the goal you all want: closing on a home!

Depending upon where you live, a common issue for mortgage lenders is getting comparable properties (comps) to make sure that the mortgage is properly secured. Because so much of real estate is local, the comps can easily be off in one direction or another. A mortgage lender who is local to your area will understand that comps a half mile to the east are accurate, while a comp from just a block west is in a different price range entirely.

Myth: A Real Estate Agent is a Waste of Money

Real estate agents often have access to properties that you don’t know about, and (like mortgage lenders) have experience dealing with the myriad little things that can go wrong during a transaction. While there’s almost nothing that you couldn’t handle on your own, that doesn’t mean that you have the time or inclination to do the hours of research at every step of the process to make sure you’re getting the best deal possible. Real estate agents are a valuable resource, especially for first time home buyers who tend to be overwhelmed by the logistic and emotional headaches of the whole process.

Myth: A Real Estate Agent Doesn’t Cost Anything

This is one of those myths that you often hear thrown around when you’re buying a home. Since both sides take their commission out of the seller’s closing, you can make the argument that there’s no money coming out of the buyer’s pocket. But where does all that money on the seller’s side come from? That’s right, it’s the buyer’s purchase price. Having a real estate agent involved in the transaction boosts the overall price of the home. But if you think that means you can simply cut them out to save money, consider the last slide one more time.

The myth is that agents don’t cost anything. The reality is that a good pro is almost always worth what you pay. And if you’re still not convinced, check out these ridiculous photos from homes for sale; these sellers definitely needed a little guidance from a pro!

Myth: Buy the Biggest Home You Can Afford

This is a harmful myth for two reasons. First, buying the biggest home on the block sets the high-water mark for sales in the neighborhood. When it’s your turn to sell, you may struggle to find comparable sale prices. Second, the number one complaint of new homeowners is that they bought either too big or too small of a home. Really ask yourself how much home you need, and get the best property for your budget, rather than maxing out square footage.

Buying a home below your max price also means that you’ll have the ability to do projects over the course of owning your home. If you’re looking for inspiration, check out this list of 12 remodeling ideas that will pay off in the long term.

Myth: Homeowners Associations Aren’t a Big Deal

Frequently a desired home will be in an area administrated by a homeowners association (HOA). Inexperienced home buyers might think that an HOA won’t really affect them. The truth is that associations have a great deal of control over what you can do, even in your home. And if you don’t like it, you have very few options.

Now don’t get us wrong: the majority of HOA’s do a great job of maintaining quality standards and looking out for their members. But if you’re looking at a home located in an area with an HOA, you owe it to yourself to do extra research before signing that contract. If you need a little inspiration as to why, review this article on homeowners association horror stories.

Myth: Springtime is House Hunting Season

Like buying patio furniture in winter, sometimes you find the best deals when it’s the off-season! Spring is classically a busy time for house sales, but in the US it’s often the end of summer that sees the most frantic offers. This is frequently driven by families eager to purchase a home in time to get a child enrolled in school. (Remember one of our earlier myths about school districts only affecting those who have children?)

The end of summer usually sees a great deal of competition, while fall and winter see the fewest buyers looking at homes. This is both due to school schedules and also because of the impracticality of moving in the middle of winter. If you are on the hunt for a new home and have more flexibility in your timeline, you can often find fantastic deals from highly motivated sellers who don’t want to incur the cost of winterizing and maintaining an empty home through cold weather months.